Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

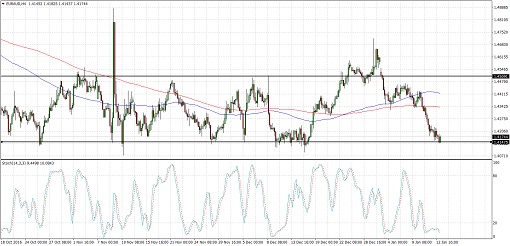

EURAUD Range Support (Jan 13, 2017)

EURAUD continues to trade sideways, moving between support at the 1.4150 minor psychological level and resistance at the 1.4500 mark.

Price is currently testing the bottom of the range and could be due for a bounce back to the top soon.

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. Also, stochastic is indicating oversold conditions, which means that sellers are exhausted and might let buyers take over. However, if selling pressure persists, price could break below the rectangle and go for at least 350 pips in losses, which is the same height as the chart formation.

Commodity currencies have been on strong footing in the past few days, supported by improved sentiment for China. This could shore up demand for commodities, as well as their prices, which is positive for the Australian dollar.

In contrast, European currencies are being weighed down by Brexit concerns, as the idea of a "hard Brexit" or having the UK give up access to the single market could also have negative repercussions on the euro zone. Prime Minister Theresa May has a speech lined up today so this should clear up some of the issues on investors' minds.

Earlier today, though, China reported a smaller than expected trade surplus for January. The reading came in at 275B CNY versus the estimated 345B CNY figure and the earlier 298B surplus. Components of the report indicated a sharper than expected fall in exports, suggesting a slowdown in production and demand for raw materials.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com