Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

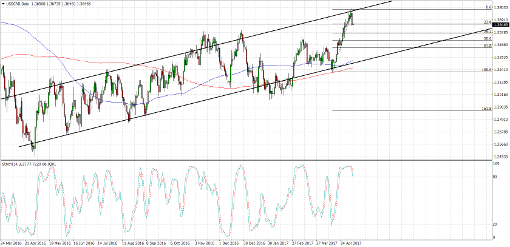

USDCAD Channel Support (May 08, 2017)

USDCAD has been trading inside an ascending channel on its long-term time frames and is currently testing resistance. If this holds, price could make a correction to support and the nearby Fib levels. In particular, the 61.8% retracement level coincides with the 1.3450 minor psychological mark and a former resistance area.

The 100 SMA is above the longer-term 200 SMA on the daily chart so the path of least resistance is to the upside. In addition, both moving averages are close to the channel support, adding to its strength as a potential floor.

Stochastic is indicating overbought conditions and is turning lower to show that bearish pressure is coming into play. Price could follow suit and could continue dropping until the oscillator reaches the oversold area and turns back up.

US economic data turned out stronger than expected on Friday as the NFP report indicated a 211K increase in hiring versus the projected 194K figure. However, there were downward revisions to earlier reports. The jobless rate improved from 4.5% to 4.4% instead of rising to the estimated 4.6% reading while average hourly earnings increased 0.3% as expected.

Meanwhile, Canada printed a 3.2K increase in hiring, short of the estimated 20K gain and the earlier 19.4K increase. The jobless rate improved from 6.7% to 6.5% instead of staying unchanged. The Ivey PMI ticked up from 61.1 to 62.4, slightly higher than the projected 62.3 reading. Crude oil price changes could also influence Loonie price action from here.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com