Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

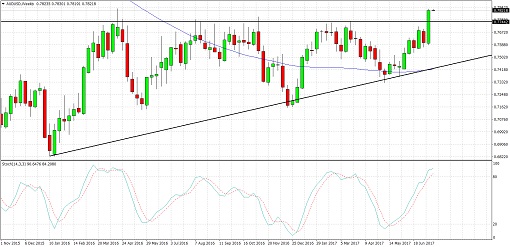

AUDUSD Long-Term Breakout (July 17, 2017)

AUDUSD had been trading inside an ascending triangle on its long-term time frame and has just broken past the resistance at the .7750 minor psychological mark.

This signals that the pair is in for an uptrend, which might last by at least 900 pips or the same height as the triangle formation.

The 100 SMA is still below the longer-term 200 SMA on the weekly chart, though, so the path of least resistance is still to the downside. However, the gap between the moving averages is narrowing to signal a potential upside crossover.

Stochastic is pointing up but is already dipping into the overbought zone to indicate weakening bullish pressure. Once the oscillator turns lower, bears could regain control and push for a pullback to the broken resistance. Stronger bearish momentum could put the pair back inside the triangle.

US economic data turned out weaker than expected on Friday, casting doubts again on another Fed interest rate hike in September or December. Headline CPI posted a flat reading instead of the estimated 0.1% uptick while the core CPI had a meager 0.1% gain instead of the estimated 0.2% increase. Headline and core retail sales were down 0.2% while preliminary UoM consumer sentiment also fell short of estimates.

There were no major reports out of Australian then while today has top-tier data from its main trade partner China. GDP is projected to dip from 6.9% to 6.8% while industrial production could hold steady at 6.5%. Retail sales and fixed asset investment could also show small dips. The RBA monetary policy meeting minutes are lined up on Tuesday

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com