Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

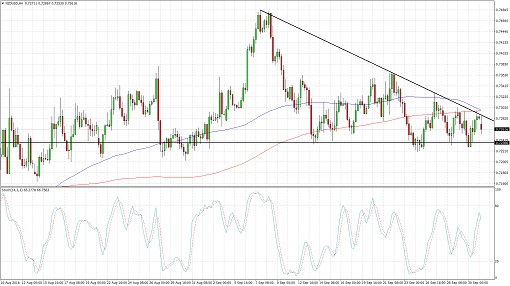

NZDUSD Descending Triangle (Oct 03, 2016)

NZDUSD has formed lower highs and found support at the .7240 area, creating a descending triangle on its 4-hour time frame.

Price seems to have bounced off the triangle resistance and is making a move towards support.

A breakout in either direction could lead to a rally or selloff of around 250 pips, which is the same height as the chart formation. The 100 SMA is above the longer-term 200 SMA for now, but a downward crossover seems imminent so sellers could take control of price action and trigger a break of support.

Stochastic is on middle ground but also appears to be turning lower, confirming that bearish pressure might return and push NZDUSD lower. So far, the moving averages also appear to have held as dynamic resistance as well.

Economic data from the US came in mixed last Friday, as Chicago PMI and the revised consumer sentiment index from the UoM beat expectations. The core PCE price index and personal income reading came in line with expectations while personal spending fell short.

The US ISM manufacturing PMI is due today and this could provide a preview of how Friday's much-anticipated NFP reading might turn out. Analysts are expecting to see a rise from 49.4 to 50.4 and are likely to pay close attention to the jobs component.

As for New Zealand, the GDT auction might be the main event this week, as gains in the dairy index have been slowing and might slump back to negative territory this week. Over the weekend, Chinese PMI readings came in line with expectations, keeping comdolls supported for now.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com