Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

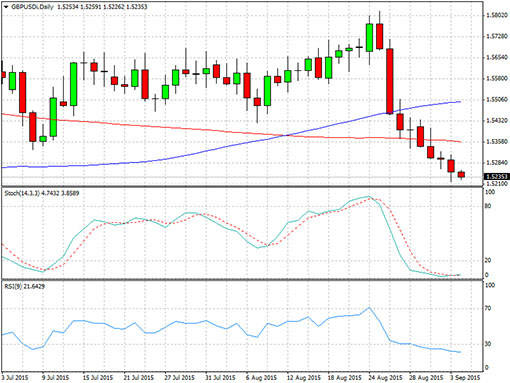

GBPUSD Long-Term Range (Sept 4, 2015)

GBPUSD has been selling off on the short-term charts but is currently approaching the bottom of the range visible on the daily time frame.

Price could bounce off the floor around the 1.5100-1.5200 levels, which have held as support since April.

A bounce off the range support could mean a move back to the resistance around the 1.5750-1.5800 levels. Stochastic is already indicating oversold conditions, which confirms that a rally is possible, while RSI is also approaching the oversold zone as well.

Meanwhile, the 100 SMA just crossed above the longer-term 200 SMA, signaling that the selloff is likely to be over soon. However, a break below the support zone could mean more losses for GBPUSD, possibly until this year's lows around 1.4600.

Event risks for this trade today include the US NFP report, which might show a 215K increase in hiring for August. This could be enough to bring the jobless rate down from 5.3% to 5.2%. Stronger than expected data could mean more demand for the US dollar, potentially triggering a downside break from the range. On the other hand, weak results could lead traders to anticipate a later rate hike from the Fed, spurring a bounce for Cable.

Data from the UK was weaker than expected this week, as the industry PMIs came in short of consensus. The manufacturing PMI fell from 51.9 to 51.5 in August while the construction PMI climbed from 57.1 to 57.3, short of the forecast at 57.6. The services PMI, which has a stronger impact on pound movement, slipped from 57.4 to 55.6.

There are no reports due from the UK today, indicating that traders' will pay close attention to the US jobs report. Average hourly earnings could show another 0.2% uptick, although a disappointing read could mean dollar weakness.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com