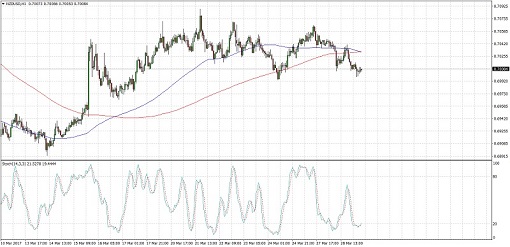

NZDUSD Double Top (Mar 29, 2017)

NZDUSD seems to be tired from its climb as a short-term reversal pattern formed on its 1-hour chart.

Price failed in its last two attempts to break past the .7050 minor psychological resistance and is testing the support near .7000, creating a double top formation.

A break below the neckline could set off a drop of at least 50 pips or the same height as the chart pattern. Price could also drop all the way down to support at the .6900 major psychological mark.

The 100 SMA seems to be making a downward crossover to show that bears are gaining the upper hand. However, stochastic is pulling up from the oversold region to suggest that buyers might take over soon. If so, a bounce back to the tops at .7050 could be possible.

Economic data from the US turned out stronger than expected, as the CB consumer confidence index rose from 116.1 to 125.6 - its highest reading in more than 16 years. The Richmond manufacturing index also turned out higher than consensus as it rose from 17 to 22 instead of dipping to 16. Aside from that, Republicans have emphasized that they will continue to pursue healthcare reform, reviving market confidence in the Trump administration's plans.

There were no major reports out of New Zealand yesterday and none are due today so market sentiment could be the main driver of Kiwi price action. Note that the UK government will officially trigger Article 50 today and a few press conferences are lined up, which should provide a glimpse of how the negotiations could go and spark more volatility than usual in the markets.

By Kate Curtis from Trader's Way