Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

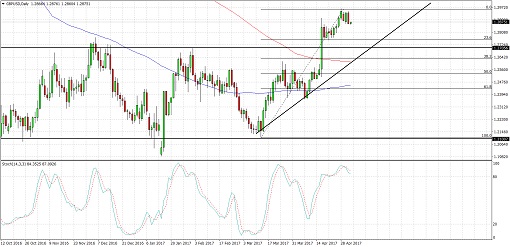

GBPUSD Range Breakout Correction (May 04, 2017)

GBPUSD recently broke past its range resistance around the 1.2700 handle and found resistance at 1.2950.

Price could be making a pullback to the broken resistance, and applying the Fib tool on the daily swing low and high shows that this area lines up with the 38.2% retracement level.

In addition, a rising trend line can be drawn to connect the lows since March this year and this support area also lines up with the Fibs and the 200 SMA. For now, the 100 SMA is below the 200 SMA to suggest that the path of least resistance is to the downside but the gap is narrowing to show that an upward crossover might be due.

Stochastic is heading south from the overbought region to show that bearish pressure is in play. This could keep the correction going until the 1.2650-1.2700 area, with the 61.8% Fib near the 100 SMA as the line in the sand for the uptrend.

Strong US leading jobs reports and the FOMC statement spurred dollar demand as both suggested that the US central bank could stay on track towards hiking rates two more times this year. Fed officials shrugged off the Q1 GDP miss and assessed that growth could continue at a moderate pace and that inflation is likely to hit its 2% target in the medium-term. The ADP jobs figure came in at 177K versus 175K while the ISM non-manufacturing PMI rose from 55.2 to 57.5, higher than the 56.1 consensus.

As for the pound, UK PMI readings have also been beating expectations, with both manufacturing and construction sectors reporting stronger expansions rather than a slowdown. The services PMI is due next and this usually has a stronger impact on the currency. Analysts are expecting to see a drop from 55.0 to 54.6 but an upside surprise might be in the cards.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com